Development Impact Fees: 1- and 5-year Reports

Per state regulations, any local entity enforcing development impact fees (DIF) must produce a five-year report detailing those charges. In line with the directives outlined in the California Government Code Section 66000 and subsequent amendments by Assembly Bill 518 and Senate Bill 1693, we present the Development Impact Fee Report for the Del Puerto Health Care District in Stanislaus County, California, for the fiscal year concluding on June 30, 2024.

DIFs are fees imposed by local governmental bodies during the approval stages of development initiatives. Their objective is to offset either partially or wholly the expenses related to public amenities tied to these developments. The legal groundwork for initiating a DIF program is articulated in Government Code Sections 66000-66025, known as the “Mitigation Fee Act.” A significant portion of this Act was introduced through 1987's AB 1600, so these guidelines are frequently called “AB 1600 requirements”.

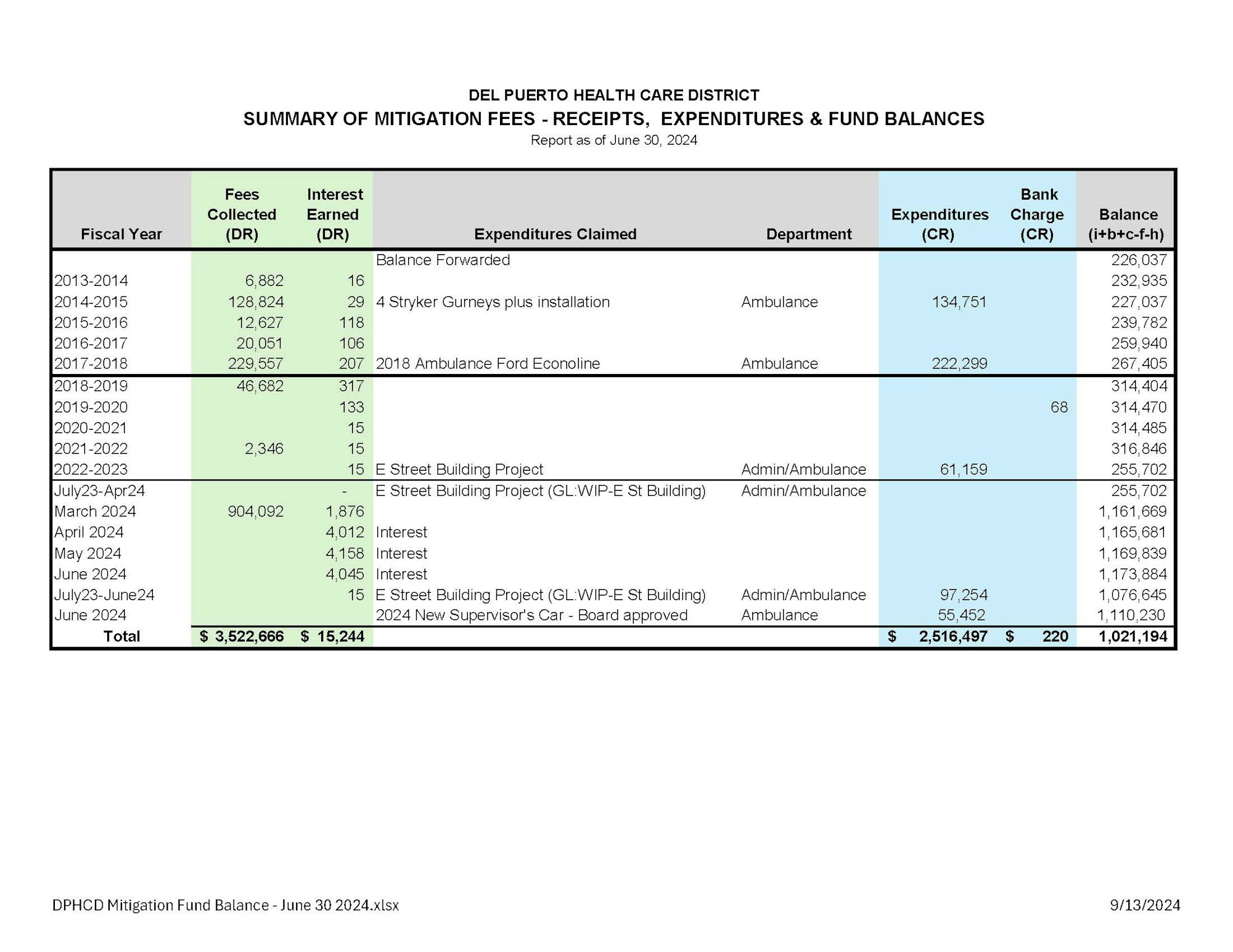

For Del Puerto, the collection of DIFs is carried out either upon granting a building permit or when a certificate of occupancy is issued. This is to counterbalance the strain on the district's healthcare infrastructure by new constructions. The revenues from these fees are earmarked for acquiring, developing, and upgrading the public amenities required due to these fresh developments. Individual funds have been instituted to monitor the impact on various services, such as facilities and expansion or adding health services.

As mandated by the California Government Code section 66006 (b) (2), the District must draft and publicize the DIF Report within six months of a fiscal year's conclusion. The District's Board of Directors must examine this yearly report in a regular public meeting at least fifteen days after its public release. This report was made available to the general public on the District's website , and physical copies were lodged with the District's Administration office on September 13, 2024.